TwinStar offers the Smart Option Student Loan to help manage student loan debt.

It used to be that the biggest concerns of a new college student were whether you’d be paired with a wacky roommate, or starve because you didn’t pay attention to mom or dad’s cooking tips.

But with the cost of college tuition and expenses at levels higher than what your parents likely paid for their first home, most college students today are rightfully concerned about the potential weight of massive student debt.

According to the Wall Street Journal, the average student loan debt of a graduating college student was $35,000 — more than twice the amount borrowers had to pay back two decades earlier. Almost 71% of bachelor’s degree recipients will graduate with a student loan. That amounts to an unfathomable $1 trillion in U.S. student loan debt.

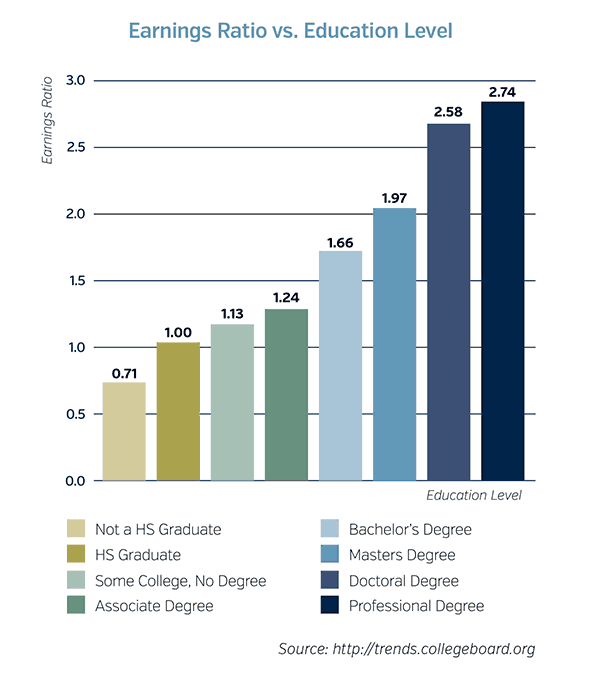

There is a real payoff for those who choose to invest in a college education, of course. The typical bachelor’s degree recipient can expect to earn about 66% more during a 40-year working life than the typical high school graduate earns over the same period.

Let’s put that into real dollars. The U.S. Labor Department reports that, in 2014, workers with only a high-school degree had median weekly earnings at $668. However, for those with at least a bachelor’s degree, the figure was $1,193. And the unemployment rate also is significantly lower for college grads.

Students and their families have plenty of options to consider when it comes to paying for college tuition. From scholarships to grants to loans, filling the gap can be a confusing proposition. Before deciding what options are right for you, there are a few important tips to keep in mind.

Start with “free” money.

While scholarships and grants don’t need to be repaid, both federal and private loans are debt that students will need to repay. TwinStar encourages members to borrow responsibly, only taking on the amount of debt you really need. We’ve partnered with education lender Sallie Mae to offer our members access to their Scholarship Search tool (visit www.salliemae.com ), with more than 3 million scholarship options worth $18 billion. When you register to use Scholarship Search, you can enter a monthly $1,000 sweepstakes.

Carefully consider how much money you need.

Keep in mind that college costs include more than tuition – you may need to include funds for housing, food, school supplies, transportation, a computer, and more. Once you have the total cost for the upcoming year, subtract any scholarships or grant money you’ve received, as well as any savings you or your family plan to contribute toward your education. This is the amount you’ll need from other sources like education loans.

Set a budget.

It’s important for students to borrow only what they need to fund their education, not necessarily a lifestyle. In some cases, the loan amount offered to you might exceed the amount of money you really need to cover your expenses. To keep your debt low, only borrow what you need to live on. Also explore options like work-study programs and paid internships through your school. Working while you’re in school may take more effort, but reducing your reliance on debt will pay big dividends in the future.

Once you’ve determined what you may need to borrow, take a look at the benefits of a Sallie Mae Smart Option Student Loan. Applying online is easy — it only takes about 15 minutes to apply. Visit TwinStarCU.com/student-loans.

TwinStar was founded in 1938 by school teachers who banded together to help each other as the nation recovered from the Great Depression. From our very beginnings, education has always been important to us. If you’re college bound, the Smart Option Student Loan takes a lot of the worry out of college financing — so you can brush up on those cooking skills before you go!