Are you ready for the unexpected?

Smart planning now can help you weather financial storms and uncertainty in the future.

Every household faces unexpected costs from time to time: a failing water heater, a car repair, or a surprise vet expense when Oliver gets the puppy flu. And beyond life’s common hiccups, natural disasters can inflict sudden hardships on entire communities in the immediate — and sometimes extended — aftermath. Recent news reports have pointed to the Northwest as being overdue for a significant earthquake that could make resources scarce and access to services — including banking — difficult while systems are brought back online.

At TwinStar, we have system redundancies and contingency plans in place to quickly restore access to your funds in an emergency, and get you the most current information about your accounts through a variety of communication channels.

However, if an emergency came up in your own personal situation, how would you manage it? Do you have funds set aside to cover the unexpected, or would you have to turn to high-rate credit cards, late payments or liquidation of your retirement fund to cover the cost? Creating an emergency fund can help you avoid costly options like these that can quickly turn your financial future upside-down.

So how much is enough to cover short-term financial emergencies? Some financial experts recommend a flat $1,000. Others suggest closely tracking your essential expenses for a month, and setting aside that amount for starts. An emergency fund that will keep you whole while you rebound from the unexpected can be a tremendous source of comfort. You can build an emergency fund by taking on extra hours at work, doing a few side jobs, holding a garage sale or simply by getting along with less (fewer fast-food trips each week!) for a few months to create a reserve for your fund.

Then, only use the fund in a real emergency. If you have to dip into your emergency fund, make it a top priority to replenish it right away. Over time, you’ll want to build your emergency fund to sustain you for a lengthier 4-6 months in the event of extended illness or unemployment. TwinStar has several tools to help you save faster, including higher-yielding money market accounts and incentive savings programs like Save to Win that offers chances to win cash prizes when you make deposits into savings accounts.

Emergency preparedness experts also recommend having a stash of cash in smaller bills on hand at your home to pay for necessities if ATMs or retail systems are down. It’s also good to have a week’s supply of food and water set aside. During most natural disasters, those in affected communities will often have to fend for themselves for the first 24 – 48 hours as first responders deal with the most emergent needs. Are you ready? To learn how to be better prepared, visit Ready.gov for sample emergency plans and information.

Crush your debt

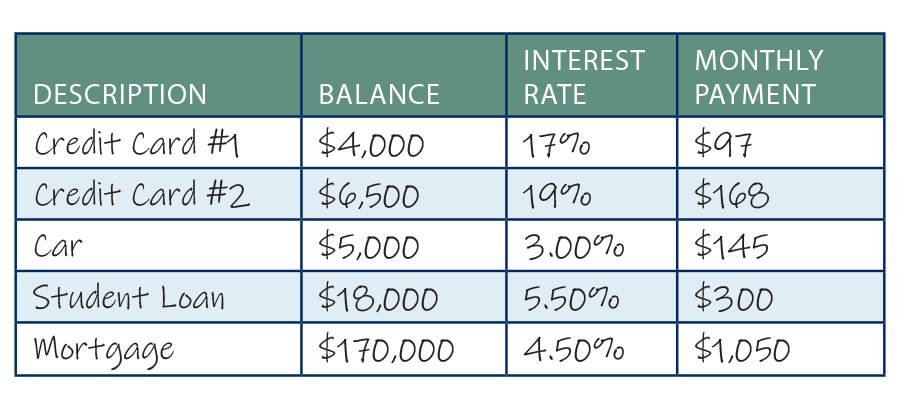

When the unexpected happens, the weight of financial debt can be a relentless and overwhelming taskmaster. However, with a little focus and discipline, you can become the master of your finances, tackling debt one step at a time. The best way to get started is putting it all on a piece of paper in front of you. It might be a little frightening as you face reality, but knowing exactly where you stand is the first step to taking control! Here’s a sample worksheet that can help you identify what you owe to your creditors.

Place the debt with the smallest balance at the top, and the one with the largest balance last.

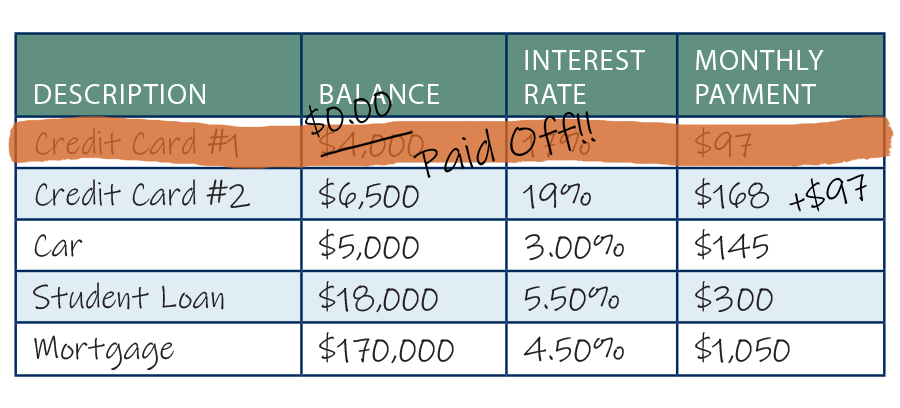

Now that you have a good visual of what you owe, you’re ready to take action. While paying the minimum payment on your other debts, take any extra cash you have and apply it toward the debt with the smallest balance. Once you’ve extinguished that first balance, add what you were paying on your first debt to the minimum payment next on the list. That will reduce the amount of time it will take to pay off debt #2. And once that one is paid off, you’ll roll over even more to the next on the list. Before you know it, you’ve crushed your debt!

And if you have high interest credit cards on that list, take a look at TwinStar’s super-low balance transfer rates. Accelerate your debt reduction by applying for a lower-rate TwinStar Visa today!